VIDEO

Claudia Natasia (Director of Product Insights at Highspot) talks about how to build and structure a team that supports strategy and growth, to to calculate the impact of investments and results against financial models (e.g. discounted cash flow), and to speak the language of investors and c-level so your team is leveraged as a strategic hedge against the negative impacts of a recession.

Like what you see here? Our mission-aligned Girl Geek X partners are hiring!

- Check out open jobs at our trusted partner companies.

- Watch all ELEVATE 2023 conference video replays!

- Does your company want to sponsor a Girl Geek Dinner? Talk to us!

Angie Chang: Claudia Natasia is a director of product insights at Highspot and she’s exploring new ways to expand the impact research beyond product and to the business ecosystem. She’s passionate about improving accessibility of financial literacy and is excited to talk about quantifying impact. She also advises startups on growth and revenue. I’m really excited to hear her speak today about her topic. Welcome, Claudia.

Claudia Natasia: Thank you Angie, and welcome to my talk everyone. Happy International Women’s Day. I’ll get started. I grew up in Jakarta and this is a photo of the financial district of Jakarta, Indonesia. And I would like to say that I actually grew up in the financial district. My mom would pull me out of school sometimes and take me to business meetings that she has in different banks in the financial district. And sometimes I had the pleasure of actually being in the meeting room and watching her close deals. And what I learned from being in this environment from early on, even at the age of five, is that it’s important to build businesses and enterprises that last. And as I transitioned my career into many different things, starting in banking right after college and then eventually landing into research data and product strategy, I always bring that learning that I have from finance of how can we use, how can we as a company use research, use data, use strategy to build companies that last?

Claudia Natasia: And that is what my talk is going to be today. I hope that everyone here can come out of this talk with several different ideas for how we can build strategies for our companies to help our companies become more sustainable, particularly during more challenging economic climate. Like today, we’ll talk about a few things. The first valuation model called the discounted cash flow model. Then we’ll talk about two case studies of how being user driven drives valuation by way of the DCF model. And then we’ll wrap up and talk about evolving a revenue-generating data practice in your organization. I’ll share some tips for whether it you’re a founder or if you currently are employed in an organization, how you can structure your product revenue, data and research team to overall drive better and more healthier valuations for your companies.

Claudia Natasia: Let’s start with the discounted cash flow model. I’ll start by asking this question, is a hundred dollars today worth more or less than a hundred dollars next year and a hundred dollars the year after? I’ll pause for a few seconds and feel free to answer this question on the chat to start a discussion or write it down anywhere. Now, similar to that question that I asked earlier, let’s assume that you just won the Powerball. Congratulations, you won a huge windfall from the Powerball. And the question now is the Powerball usually does payouts in two different ways. The first way is a lump sum where they give you less than the amount you win, but they gave give all of it right now less taxes. Or you can also opt for this thing called an annuity that pays the, the, the funds that you win from the Powerball in a yearly manner. Would you rather take the lump sum so that huge chunk of money that comes right now, or would you rather take the annuity a smaller amount of money year on year until let’s say 30 years? That’s usually the timeframe of the annuity.

Claudia Natasia: I’ll give a few seconds so you can think about that as well. Alright, I actually ask this poll to a large number of people in my company the other week. And actually 72% of people answer lump sum and 28% annuity. And there’s really like, it, it’s a matter of preference at the end of the day, but also from a fiscal or financial sense, there is actually a right answer, even though at the end of the day it is a really a matter of preference. We can go debating this over and over again, but from a financial perspective, the answer is actually take the annuity. And I did a calculation to show why it’s important to take the annuity. Let’s assume that the Powerball, when I did this calculation, I assume that the Powerball was a hundred million. I don’t know what the amount is now, frankly, I’ve never been part of the Powerball, but let’s assume that the, that the Powerball is a hundred million dollars.

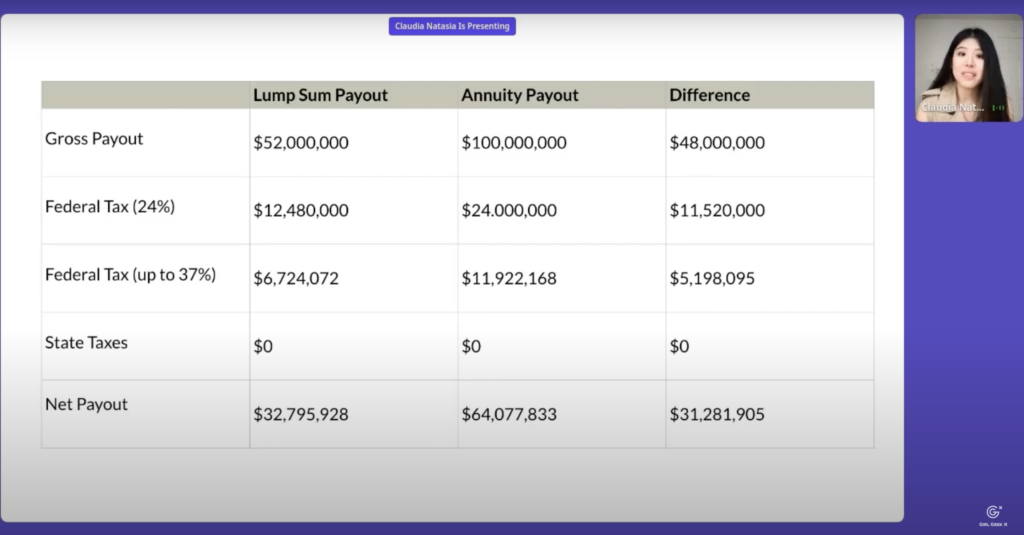

Claudia Natasia: If you were to take the lump sum payout, you’d get $52 million right now, less the federal tax at 24%, and then you’d get a net payout of around $32 million. Whereas if you get the annuity over time, over 30 years, you’ll actually net at $64 million, meaning you’ll actually get $31 million more, which is two x the amount of the lump sum pay out. That’s really amazing to see the difference between these two values. People often wonder why, how come the annuity, even though you don’t get the psychological reward of getting the money now, you actually net out with more. And what a lot of people don’t know is the Powerball annuity is actually paid through investments in bonds. The investments in treasury bonds actually has an interest rate of around 5%, so if you were to, let’s say, not invest in the stock market at all and you invest in government bonds, you’d net around 5%.

Claudia Natasia: Sometimes in good markets, of course, if you like let’s say invested in Bitcoin like four years ago, you’d probably net like three x higher, like I think at one point the increase was like 300%. But in certain markets there’s this thing called the risk-free interest rate where the for the risk-free interest rate in in particular, that’s the rate that you’d get if you invest your money in a safe product like government bonds. And the reason why annuity pays more and more each year is what Powerball assumes is if you were to take the money right now, you could invest it elsewhere. And the hope is that actually with the annuity, that if they were to keep the money and pay you on a yearly level, that they need to at least match the risk-free interest rate of 5%.

Claudia Natasia: Now let’s shift our thinking a little bit to the actual markets. I bet a large number of you are founders or part of a company that is actually VC-backed. By VC, I mean venture capital. And when you look at venture capital funding in the past just five years, you actually see an interesting trend in during the pandemic, we see venture capital funding actually increase drastically. And only recently because of the more challenging macroeconomic condition and rising interest rates and wars in in Europe, we actually start to see venture capital funding decline. And during periods when funding decline, VCs and investors, similar to if you are also an investor in the market, you become more picky on the type of companies that you want to invest in. And for the companies that you’re already invested in, you also pay more attention to fundamentals. You go back to very important fundamentals, business fundamentals of increasing sales while also being efficient and minimizing costs.

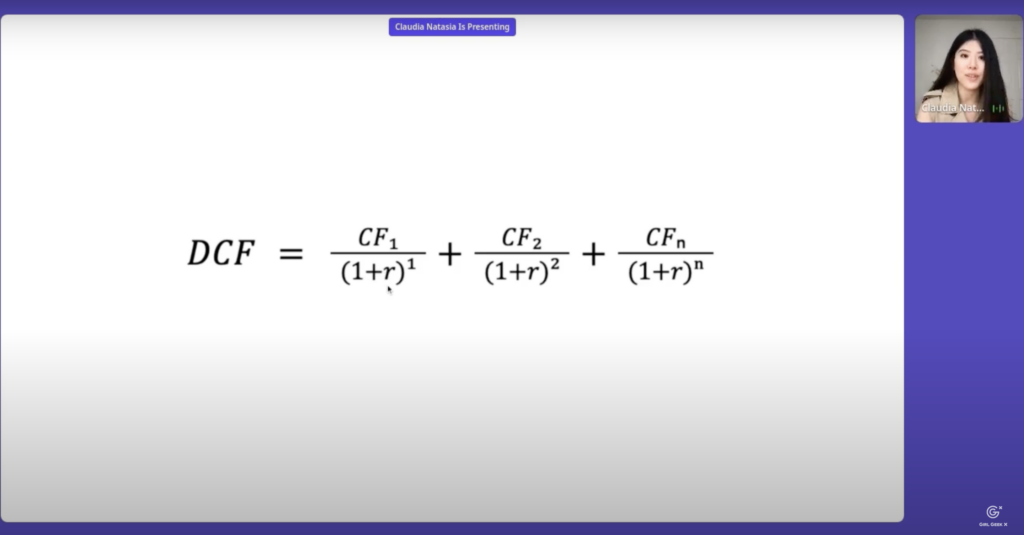

Claudia Natasia: And what VC is always used to calculate the valuation of companies is this thing called the discounted cash flow model. It’s actually a very, very simple formula that is a function of the cash flow that a business receives year after year. It’s a revenue less cost, that’s the CF and enumerator discounted or divided by a function of the interest rate. And this part is really, really interesting because as you all know right now, interest rates have skyrocketed. That’s why we’re seeing ramifications the mortgage market. It’s harder for people to get mortgage. If you could afford a home that’s let’s say $1.4 million last year with mortgage with the increasing interest rate, right now you could probably only afford a home at a lesser price because your mortgage is more expensive. And so when periods of r so r indicates interest rate in this formula.

Claudia Natasia: When r increases, when the Fed increases interest rates, then regardless of what cash flow you have, like assuming your cash flow is stagnant and even if it grows a little, that value will be eaten up by the increase in interest rates from this formulas perspective. And that’s the important thing for us all to know, as either founders or shareholders of our very own company as employees, is that we need to do more with less right now in this market, even if we’re able to grow our revenue by 20% this year because we were still able to maintain great sales velocity in a challenging macroeconomic climate. Note that a 20% increase in sales this year matters less than a 20% increase in sales last year because the interest rate has grown like nearly double at one point compared to two years ago. And that’s why it’s very important for companies to understand how we can build strategies that ensure that our cash flows in this DCF model are robust regardless of the macroeconomic condition in the world.

Claudia Natasia: What are the factors that typically drive strong healthy DCF models or strong healthy valuation? I listed a few different factors in the relationship to the DCF model sales. Of course, as you increase sales, you would see an increase in cash flow and a positive relationship to the DCF model. And a driver of sale is achieving product market fit. If you are starting a company and you are able to achieve product market fit earlier on and have customers that recommend your product or your experience to other customers and then drive like stronger horizontal growth on all of your product suite and continue to capture more and more of the market or even define your own market cap, then you can actually achieve stronger product market fit. And of course stronger sales and closely related to sales is growth. Growth also has a positive relationship to the DCF model.

Claudia Natasia: And companies typically achieve growth through these terms that you may have heard before, like acquisition, acquiring new customers, adoption, having customers actually use your product and using it more and more, which is engagement. And like what I said earlier is also recommending other people to use it and things like activation. Going through the entire horizontal and vertical growth of your product, using more of of your product’s, compliments that you also build in your company. And upselling and cross-selling, I’m actually getting ahead of myself because I just described the third driver of DCF which is actually retention. And retention also has a positive driver, like I mentioned it, it leads to cross sells and upsells. If you’re able to get customers to buy more of your product, like let’s say your company, what’s a great example of this… Like if your company sells a learning and management software, but also a conferencing software, if you’re able to get your customer to buy not just the LMS but also the conferencing software, then you’re essentially driving cross sells, which it’s the same customer but you’re driving more revenue from that particular customer.

Claudia Natasia: And then there’s things like lifetime value also, assuming that the customer doesn’t cross sell or upsell, they don’t buy more of your product suite, there is an opportunity of course fundamentally to just retain them, keep them year after year to come back and use your product and not jump ship to a competitor. And other drivers of DCF includes costs. There are several different types of costs and I’ve highlighted two major classes of costs, cost of goods sold. So if you were to produce a a product or a experience, what is the cost of actually producing that product? And then also operational costs of running your business. And then finally, like we’ve discussed in the previous slide, interest rates, which is driven by macroeconomic conditions and generally what the government decides to set the interest rates at. All of these factors work together with each other to ultimately influence the discounted cashflow model and the valuation of your company. And if you’ve read some tech news recently, that’s actually why we are seeing quite a bit of companies experience declines in their, their valuations recently because of the higher interest rates in the more challenging fundraising environment.

Claudia Natasia: Are there other ways we can hedge for revenue? Outside of what I’ve described on a DCF model? I’ll describe two case studies for how being user driven actually help hedge for revenue. The first is how a user-driven approach uncovers revenue generating opportunities. And I’d like to introduce everyone to this framework. It’s called the value frontier. There’s two different elements of this framework. One, if you’re a business, of course you want to drive value to your business. Like we saw in the DCF model, we want to drive more revenue, but also you want to drive value to your users.

Claudia Natasia: And the hope is that as you build more and more products or more and more features that you get closer to this frontier where you’re unlocking and creating value both for the business and both for the users. We were actually able to create that at this company I worked with in the past called Five Stars. Five Stars originally started as a loyalty company. If you’ve been to a boba store, you may have inputted your phone number and joined the Five Stars loyalty program. It was an amazing product and many, many people loved using it, but we wanted to do more with this product. And so what we did was we conducted user research. A lot of the researchers in the team went out to the field, went to all of the small businesses that used Five Stars to try to get a general idea, like an ethnographic perspective of how are people using the product and how can we improve the experience.

Claudia Natasia: We also mined revenue analytics data and created models against average revenue per user and closed loss feedback, which in sales terms is basically we weren’t able to to sign a deal with a customer, what was the reason behind their close lost deal. And we actually build a machine learning model that analyzes the text of all of the reasons behind the, like why we weren’t able to sign that customer. And then finally we use a combination of product analytics health metrics of all of our product suites to come up with an opinion of what can we do to actually drive more value to both five stars and our small business owners. And that ultimately led to the largest product pivot that I’ve frankly done in my career, which is to pivot the Five Stars loyalty program to become a payments provider. And we actually build all of this in-house. And ever since then, small business owners are able to take payments also that’s linked to their loyalty program and, and have this in store. And essentially what we did was we created value by driving this in-store loyalty program to become a mobile payment service that ultimately drove a multimillion dollar acquisition of five stars by a European point of sale company called SumUp.

Claudia Natasia: My next case study is on how being user driven reduces invisible liabilities and speaking about invisible liabilities. What are invisible liabilities? I like to use this example from friends. I don’t know if anyone here remembers this particular episode or even watch friends, but in this particular episode we, we all know that Monica is the character known to be very, very neat and very, very tidy. And her husband Chandler actually opened a door that he never realized was in their apartment. And behind that door was all of Monica’s mess just stashed inside. And essentially this really describes invisible liabilities because invisible liabilities are all of the things that it, it’s, think about it like tech debt or product debt. It’s all of the things that we don’t want to deal right now that we just stash somewhere. But eventually we will have realize that eventually they become a reality.

Claudia Natasia: In this particular example in this company that I worked with, customer support costs were rising and we didn’t know why. We were pretty successful at reducing the cost. It takes a support customers from a customer service perspective in year one. But in year two we started seeing it drastically increasing like in this hockey stick chart. And so what the team did was we mined 9,000 support call data, did one ml text analysis of all of the feedback on that support call data to find out the root cause and uncovered that these, the, the root cause of the increase in costs were actually three major user experience issues that were not fixed. It led to an average of five repeat calls of 30 minutes each. And assuming that the calls were $1 per minute, like the, cuz it, it takes of course we have to pay when we answer a call from a customer, it leads to $225,000 of extraordinarily loss not accounted for.

Claudia Natasia: We were able to fix this and of course reverse the loss that we had accumulated. But imagine if we had been more intentional earlier on to be more user driven to actually uncover and fix these UX issues, we would not have accumulated all of these costs. And that’s the scary thing about invisible liabilities is no one can see them until it’s too late. That’s why they’re called invisible. And so let’s update the DCF model. There are two things that ultimately drive discounted cash flow in addition to all of the things that I mentioned. New product pivots and invisible liabilities are also examples of things that could drive DCF.

Claudia Natasia: And both of these things are driven and discovered by strategic user research. I’ll end by describing how to build and empower a revenue generating research team or a revenue generating data and strategy team. And I’ll give a quick example of Uber. If you were to ask my mom 20 years ago if she would let me jump into a stranger’s car, she would definitely say no. But right now I’m going to Indonesia in a month and my parents actually told me to take an Uber from the airport. If Uber were to ask people 20 years ago if they would jump in a stranger’s car, probably the product would not have been built the way it was built today. Similar to the approaches that sometimes we take when we do research by building empathy maps like this, empathy maps are fundamentally not a great way to do research because they actually diminish innovation.

Claudia Natasia: When we’re asking people what they empathize with, what they do, what they see, all of this is limited to what currently exists in the world. If you’re building game changing products and experiences, you can’t ask people all of these things since their perception will be limited to what’s in the world today. And so instead of asking all of this, I would encourage founders, research practitioners, data, product managers, anyone in in the industry to think about data from a more strategic lens.

Claudia Natasia: And instead of asking what users want, ask these three questions. One, how can we influence user behavior? Two, how do users behave? And then three, is our strategy working efficiently and using a combination of both qualitative research, quantitative research, and also more machine learning and and advanced statistical analysis. And do not be afraid of combining all of those different types of data sources to ultimately form an opinion that will drive your revenue and your valuation strategies for your company.

Claudia Natasia: And I’ll end with the statistics. Two x higher growth is experienced by user driven companies as measured by a reset study from McKinsey. I encourage everyone today to shift your mindset away from just being product driven or sales driven and find ways to incorporate data to be more user driven to drive stronger and more sustainable valuations for your company. Thank you everyone. Please feel free to ask me questions on my Twitter account or I’ll be hanging out at the lounge after this. And happy to answer any questions that you may have. Thank you.

Angie Chang: Thank you Claudia. That was an excellent talk. I think people learned a lot and there’s definitely some comments and requests for slides, so if you can share them on your LinkedIn or put them in the chat, that person can get them. Thank you so much and we’re gonna start our next session. So yeah, good to see you. Thank you so much for joining us on International Women’s Day and we’ll see you at the next session. Bye.

Like what you see here? Our mission-aligned Girl Geek X partners are hiring!

- Check out open jobs at our trusted partner companies.

- Watch all ELEVATE 2023 conference video replays!

- Does your company want to sponsor a Girl Geek Dinner? Talk to us!