VIDEO

Danielle McLaughlin (Founding Head of Talent at The New Club) shares details on how to think about equity percentages and basis points, and how to approach negotiation for titles, responsibilities and more. Attendees will participate in an exercise for getting clear on your non-negotiables before entering the negotiation, resources for finding jobs at early stage ventures and how to approach equity. Learn how to prepare for negotiations at early stage ventures, from co-founder negotiations to founding engineer roles at pre-seed or seed start ups.

Like what you see here? Our mission-aligned Girl Geek X partners are hiring!

- Check out open jobs at our trusted partner companies.

- Watch all ELEVATE 2023 conference video replays!

- Does your company want to sponsor a Girl Geek Dinner or Career Fair? Talk to us!

Angie Chang: My name’s Angie Chang, founder of Girl Geek X, and we have with us today Danielle McLaughlin. She has a decade of experience in recruiting and talent leadership at some of the fastest growing companies in tech, including Square, Lyft, Waymo, Blend, Fitbit, and Fast, and with her deep knowledge of a technical root recruiting environments and methodologies to help businesses scale, Danielle is currently the founding head of talent at The New Club. She helps engineering women land impactful roles at startups and we’re excited to hear her talk today. Welcome, Danielle.

Danielle McLaughlin: Hi, everyone, I’m Danielle. I’m one of the founders of The New Club. Super excited to be here today. I lead our talent initiatives at The New Club, but we will tell you all about that in the session a little bit later today. In case you don’t know about The New Club, we are a private network for women in engineering. We offer community and job search support for finding roles at startups.

Danielle McLaughlin: Today, I’m going to be talking about how to negotiate at early stage startups. It’s a topic that I get asked about a lot from our community members, how to transition from larger companies to startups and how to talk about equity. I’ll quickly flash today’s topics and key points around getting clear on what you want, what questions to ask, and compensation breakdowns, all part of the journey of your job search.

Danielle McLaughlin: A little bit about me, I’ve been recruiting for 10 years. I’ve worked at a number of different startups and large public companies ranging from two employees to 5,000 employees. I’ve worked for companies like Lyft, Waymo, Fitbit, and Square, and I’m really passionate about helping people, particularly helping technical women excel in their careers. Outside of work, I teach yoga, I spend time with my dog, Fred, who’s here on the screen, and I love to spend time in nature.

Danielle McLaughlin: For today’s session, I wanted to clarify the focus for the advice in this presentation. There’s a lot of nuance in the startup world from bootstrap businesses to VC backed ventures, all stages and sizes. I’ve decided to focus on the most common scenario I get questions on, which is negotiation for the first engineer or early engineer out of venture backed startup, more specifically, pre-seed to series A or within the first two to 15 employees.

Danielle McLaughlin: The first step, the first step in any successful negotiation is getting clear on what you want and understanding where you’re at in your overall career progression today. At The New Club, we host retreats for women in engineering, including workshops on this very topic. All the photos you’ll see in today’s presentation are actually from one of our most recent retreats where we talked about career design and setting goals and milestones. I’ll touch lightly on the stages of the job hunt journey.

Danielle McLaughlin: The first step is really to clarify what you want from your next job and clarify where you’re at in your career today. The second step, defining what types of opportunities fulfill those. The third, evaluating startups potential, which we’ll cover a little bit today, and of course, we’ll also cover negotiation on compensation and equity. Before you interview at an early stage startup, it’s important to think about some of these questions at a deeper level than you would maybe in your standard job search.

Danielle McLaughlin: You’ll be jumping into a riskier venture that will push you in ways that you don’t expect. Some questions to think about might be what are the key skills that you bring to the table that set you apart from the other early team members, and this can be really beneficial when you’re working in a small team. Each person should bring something unique to the table and you really want to have a strong sense of what your unique skills are. The second is what is your collaboration style? How do you work in teams? Do you prefer remote or in-person environments? Are you an extroverted problem solver? Do you like to think out loud or do you like to work through problems on your own?

Danielle McLaughlin: When working in a small team, these types of differences between team members can be super, super helpful to iron out as you’re getting to know your team before you join an early stage venture. The third is how do you usually resolve interpersonal and communication issues? Working in a small startup means working in a high stakes environment where stress is likely to come up a little more frequently. How do you handle stress? How do you communicate when you’re under pressure? These can be really good things to think about as you’re going through the negotiation processes. As you’re meeting new team members, you want to have a sense of how you like to work and communicate that to your new team.

Danielle McLaughlin: The fourth is how much flexibility do you have in your life across your time, finances, or energy? I find this comes up a lot in startups when people are thinking about potentially making the move. They say, “Well, I just don’t have the time to really work on a startup 24 hours a day.” In reality, everyone is in the same boat at an early stage startup and everyone has different amounts of flexibility in their personal life. Setting these expectations upfront can really help your team to succeed and you can really work together to design a working environment that works for all of you.

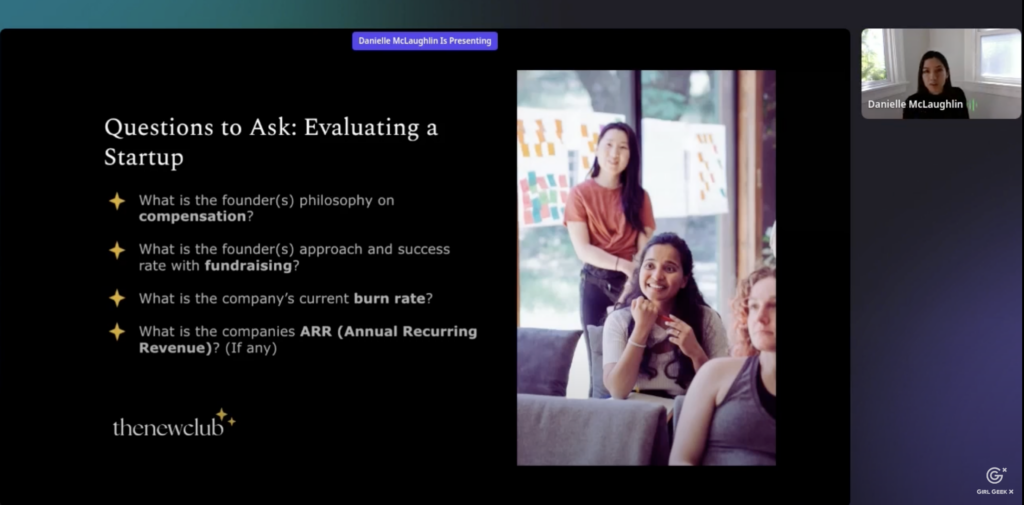

Danielle McLaughlin: All right. Next, questions to ask before talking compensation. These are questions that will likely come up as you’re talking to this potential startup. I’ll be focusing on these questions because I usually get asked about how to negotiate the financial health of a startup from women in our community.

Danielle McLaughlin: The truth is that in early stage startup, there’s a lot of variability in businesses and the companies we’re talking about, maybe pre-revenue, they may be pre-product market fit. The first two questions are best in that type of scenario. If the company is series A maybe and beyond, you may be able to go into the last two in more detail. I’ll start with what is the founder’s philosophy on compensation?

Danielle McLaughlin: This really matters in the early days as a lot of different founders have different ideas of what pay should look like at an early stage startup when there is no product and there is no revenue coming in. Should all of the founders take the same amount as the first five people on the team in terms of their base salary? Should equity be equally distributed, and then how should that grow over time? You also might want to ask if they are paying at a certain percentage of the market, and I’ll talk more about this later on, but these are all questions that you can use when thinking about your own compensation within the startup later on.

Danielle McLaughlin: The second is what’s the founder’s approach and success rate with fundraising? This is a very important question, especially if you are looking at a founder that this is their second venture, and you want to really understand what their approach to fundraising is going to be in the future. Are they going to fundraise on an annual basis and are they looking to bootstrap the business? There’s a lot of complexity there, as well as who are their previous investors. The last two, as I said before, are probably going to be more relevant for companies that are a little bit further along. What is the company’s burn rate?

Danielle McLaughlin: How much money are they spending on operating expenses and salaries month over month, and what is the company’s annual recurring revenue, if any? When you’re understanding the health of a company, a startup, the last three questions will be crucial to understanding the health of the business. For example, if a company has only raised a million dollars and they have no recurring revenue and a burn rate of 100K per month, they will not last very long or more than a year. I can talk more about that in more depth in one-on-one sessions if you would like help understanding the financial viability of your startup. All right, the meat of the presentation.

Danielle McLaughlin: Let’s get into breaking down startup equity. How does startup compensation work? The world of private equity is quite complex, so for those of you who maybe work at a public company, you might be moving from RSUs to options. Terms might come up like common stock versus preferred, dilution is a topic that I get asked about a lot, which I’ll cover in not a lot of detail because we only have a short period of time today, but general guidance, I think, is good to know. A good benchmark for distributing early equity. Ownership of equity between investors, founders, and employees looks a bit like this.

Danielle McLaughlin: Founders generally will get 50 to 60% of the equity pool, investors will get about 20 to 30% of the equity pool, and employees about 10 to 20%. That last 10 to 20% is the amount of equity that will be distributed amongst employees, but not all of it will be distributed in most cases.

Danielle McLaughlin: What are equity percentages and basis points? Equity percentages help you project what you will potentially make from your grant long-term. These are some industry benchmarks around how much engineers might expect to get at the early stages. Co-founders may expect to get 30 to 50%, first founding engineers anywhere from 0.5 to 5%.

Danielle McLaughlin: At the bottom, I’ve broken down a very simple conversion rate for basis points, which are a cleaner way to reference your ownership amount, but they’re usually used by investors, traders, and analysts.

Danielle McLaughlin: Basis points are helpful when thinking about dilution of equity, which we won’t go into in a lot of depth today, but maybe a simple way to think about it is if you’re getting less than one basis point, you may not be getting a significant amount of equity at this stage as an early engineer. To break this down a little bit further, we can see for our first founding engineers and our early founding engineers, your equity percentage lowers with time and increases with impact.

Danielle McLaughlin: The earliest engineer that is going to be the most impactful to building the product, maybe pre-revenue, pre-product market fit, can argue for a much higher percentage of the company as they’re going to be the first person building the product and really helping the company succeed. The more engineers that join the company, the lower the percentage will go as relative to impact.

Danielle McLaughlin: Let’s jump into an example. Let’s say you are a level five software engineer at Meta with five years of experience. You have a bachelor’s degree and a master’s degree in a field that’s relevant to the company that you are interviewing at.

Danielle McLaughlin: Your offer is a senior software engineer at an AI company, very relevant to your background, and your offer is 180,000 with 0.8% equity. How might you think about negotiating for this role?

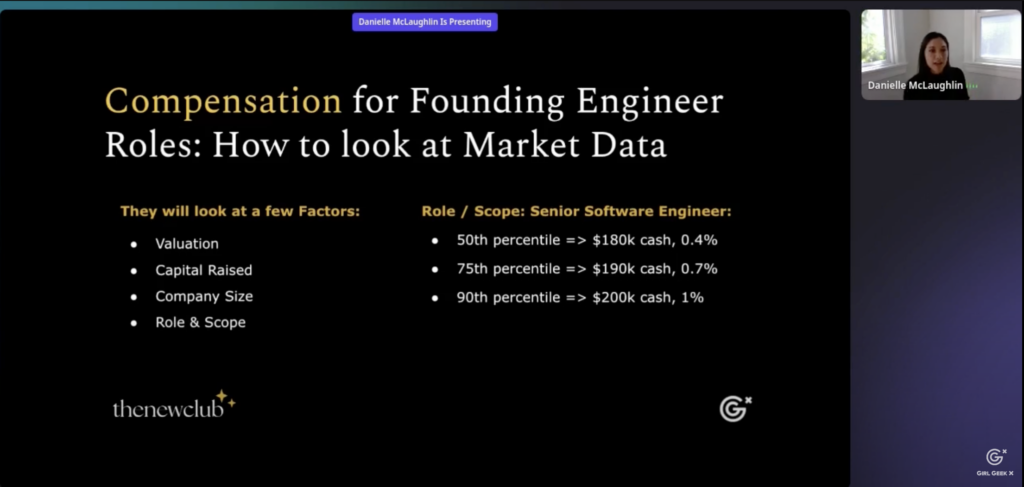

Danielle McLaughlin: To start, you would want to take a look at market data. This is how the company may be formulating your offer. They will look at a few factors ranging from valuation, capital raised, company size, role and scope. In terms of the offer that you would see in market data, you will look at percentages. It looks like for the offer that I shared in the previous slide, the company decided to come in at 180,000 cash, which is at the 50th percentile, and 0.8% in equity, which is a little bit above the 75th.

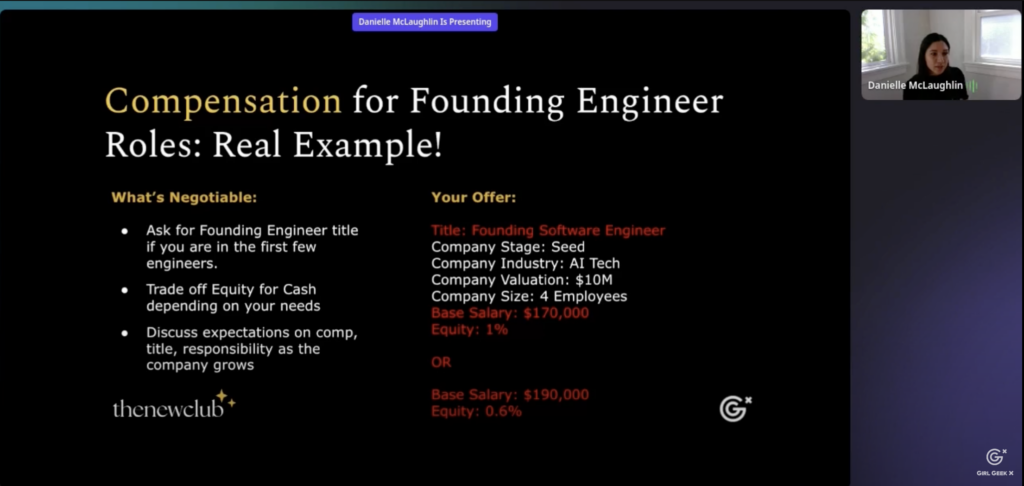

Danielle McLaughlin: When you’re thinking about your offer, what’s negotiable here? First, I might ask for a different title. If you are within the first few engineers, if you’re going to be building the product and there’s no revenue coming in, you’re really going to be a crucial part of this business. You are truly a founding software engineer, so I might ask for that.

Danielle McLaughlin: The second is the trade-off between equity and cash. If you’re at a point in your life where maybe you don’t need as much cash right now, you can certainly trade that off and ask for more equity. If on the other end, you are looking for more cash right now, you can ask for a lower percentage on equity.

Danielle McLaughlin: Of course, there are other examples here where you could ask for more or less on these components and I would’ve to talk to you at a case by case basis to review that, but the last point is discuss expectations on comp and title and responsibility in the future.

Danielle McLaughlin: I’ve seen a lot of creative strategies here where I’ll see folks put in their offer letter. At a year, I’d like to review my compensation or get X percentage if the company hits X goals. That’s it for the content. Here’s some additional resources that were really helpful for me.

Danielle McLaughlin: The first is a book, Getting to Yes. This was actually given to me by one of my first managers and mentors in recruiting. It has certainly helped me a lot.

Danielle McLaughlin: The second is a Master Class. Chris Voss teaches the Art of Negotiation. These are very simple, short videos. You can listen to them before work. I find them really practical and helpful, and the third is The New Club talent. Our community and company, we help women find jobs at startups, we help with negotiation and other areas related to job search support. The last two, these are really excellent resources for compensation at startups. Topstartups.io is actually built by Linda Zhang, who’s a female entrepreneur so love linking that one, and then the last one, Pave is a new and popular resource for companies so wanted to list that one too, and that is it.

Danielle McLaughlin: I’d love to answer any questions in the chat and you can follow this Bitly link to link to our website. Okay. Questions, can you give us an example of where you can negotiate a higher salary on both base and equity and how you would approach the negotiation of convincing the startup to give you what you want? Great question. She is referring to a previous slide where we talked about the offer here in relation to market percentages and then this trade-off example that I gave. It’s true that if in all cases, you don’t need to trade off equity or cash, I think that using data to come into the conversation can be super useful. Remember that your founders may not be experts in this space.

Danielle McLaughlin: Sometimes there’s a bit of education that happens at this stage, making sure that you have both this market data and your personal factors that you’re bringing into the conversation. I often see people leverage other offers. Maybe the startup that you’re talking to doesn’t have a good sense of market data and you can bring those offers to the table and talk about what you’re seeing in the market as a leverage point for asking for more. I would also argue that if you are going to be really, really impactful to the organization, you want to show that and argue potentially for level or comp at a higher level potentially than what they have offered.

Danielle McLaughlin: Great question. Let me look at the next ones. Can you speak more about the percentage and base for non-tech and the same question? Yeah. So this data is available for non-engineering roles as well, and the compensation percentages for those are formulated the same. The same methodology applies here, the same negotiation tactic. Depending on the type of company or the type of role, your skills will be more beneficial to that company. For example, if it’s not a technology company, if it’s a company that focuses more on SaaS or some other kind of business related area, your skills might be way more relevant and therefore, your equity percentage could be much higher in those cases. I would apply the same methodologies that I talked about here for engineers to those roles. Good questions though.

Danielle McLaughlin: What are good places to look at for market data? I shared a couple of examples towards the end of the slide. Topstartups.io is a great one, Pave is a great one. Levels.fyi is a crowdsourced website as well. Those are all really great resources to look at compensation data. I will say though, for a lot of the resources that I’ve seen online, the base salary reported in those examples is usually more accurate than the equity, and the reason for that is the values are listed in Levels.fyi, for example. The actual dollar amount is listed as an example and that can be highly variable depending on how the company views its valuation or how the person has calculated their own equity if they’ve received other grants throughout their lifetime there.

Danielle McLaughlin: I do think that one is a great resource. Your example was for a startup that raised 5 million. How would the approach to equity differ for an early stage that raised more than that? Yeah. Well, if the company is worth more money, your percentage is going to be worth more. The conversation would mostly change around that. You might actually receive what looks like less of a percentage if the company is more valuable, but yeah, I can talk more about that one-on-one, Rebecca. Would love to help you if you have an offer there, but yeah, thank you guys so much for having me, and thank you, Angie.

Angie Chang: Thank you, Danielle. So Danielle will be back on stage at 11:50 to talk about The New Club and then in her virtual booth, The New Club at noon to 1:00 PM Pacific time. So please go chat with her there as well and we’ll be hopping to our next session. Thank you, Danielle, and see you in the next session, everyone.

Like what you see here? Our mission-aligned Girl Geek X partners are hiring!

- Check out open jobs at our trusted partner companies.

- Watch all ELEVATE 2023 conference video replays!

- Does your company want to sponsor a Girl Geek Dinner or Career Fair? Talk to us!